will child tax credit monthly payments continue in 2022

The enhanced CTC payments were originally included in the American Rescue Plan to help families through the pandemic as previously reported by GOBankingRates. The plan raised the existing child tax credit from 2000 to up to 3600 per child for ages 5 and younger and 3000 for each child aged 6-17.

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit SS.

. Will the Child Tax Credit be extended. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. As it stands right now child tax credit payments wont be renewed this year.

The Fed plans to raise interest rates again in June to cool rampant inflation fueled in part by gas prices that continue to climb into uncharted territory. The law authorizing last years monthly payments clearly states that no payments can be made. Child Tax Credit.

If Congress does not act it will continue uninterrupted in 2023. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. Food insufficiency rates.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. Washington lawmakers may still revisit expanding the child tax credit. However parents might receive one more big payment in April 2022 as part of last years plan.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains unknown. This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Child tax credit payments will continue to go out in 2022. Distributing families eligible credit through monthly checks.

The monthly Child Tax Credit payments that were issued to millions of American families helped to reduce child poverty by more than 40 last year according to reports. Arents in the United States could have some potentially good news on the way with there possibly being a double Child. The payments wont continue in 2022 for the new year.

2 June 2022 - New York Stategas tax holiday goes into effect Wednesday. A bill drafted by the Biden administration could cover back payments of the 2022 child tax credit. 250 going to parents in one state Will the tax savings program continue in 2023.

What is needed to receive a 1400 payment in 2022. However President Joe Biden s administration is crafting a bill that would. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Staff Report March 14 2022 517 PM. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. - Fed Chair and President to met at White House to discuss inflation on Tuesday -.

Will the dependent care credit continue in 2022. In 2021 President Biden expanded the child tax credit from 2000 to 3600 and let families collect monthly payments in advance. Half of the credit - 1800 or.

The advanced payments of the credit will. President Joe Biden is pushing Congress to extend the monthly child tax advances.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

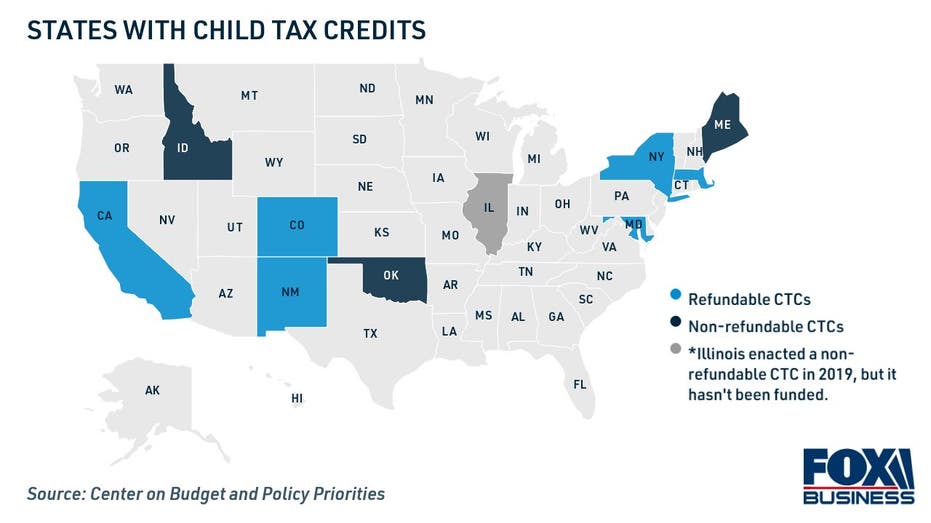

Child Tax Credit Advocates Propose New Way To Expand Monthly Payments For Parents Fox Business

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

What To Know About The Child Tax Credit The New York Times

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Child Tax Credit When Will Monthly Payments Start Again Fingerlakes1 Com