maine excise tax refund

4179 is similar to H. Download Print e-File with TurboTax.

Montana Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income.

. Using deductions is an excellent way to reduce your Montana income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Montana tax returns. Mississippi Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income. Generally your refund will be 100 of the property tax paid on eligible property for the first twelve years for which you claim.

If you are not approved for medical cannabis by a doctor for whatever reason we issue a refund in FULL. If you have questions about receiving these advance payments from the IRS please visit wwwirsgov for details. Maine for instance provides a sales tax credit dependent care tax credit and a property tax circuit breaker that was recently enhanced.

2020 Claim for Refund of Income Tax Return Preparer and Promoter Penalties. State personal income taxes with few deductions or exemptions to benefit the rich such as capital gains loopholes or itemized deductions tend to be progressive. 2021 Installment Sale Income.

Please re-enter your e-mail address. S Corporation A corporation is a person or group of people who establish a legal entity by filing articles of incorporation with the states secretary of state granting it certain legal powers rights privileges and liabilities. Download Print e-File with TurboTax.

Great communication from their staff and had me in a. For tax years 2020 to 2022 AB 85 enacted in 2020. Using deductions is an excellent way to reduce your Mississippi income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Mississippi tax returns.

The law states that eligible property must first be placed in service in Maine after April 1 1995. Fast and efficient no issues. The Ohio Department of Taxation will not be issuing advance Child Tax Credit payments to taxpayers.

Targeted policy decisions to phasedown or. S Corporation Formation - Corporate officers members or managers click here to start and file your online application for your federal IRS EIN TAX-ID number. PO Box 9107 Augusta ME 04332-9107.

4042 would create a 625 excise tax on the annual revenue from the digital advertising services provided in Massachusetts while exempting the first 500000 in revenue from Massachusetts digital advertising services. Return of Excise Tax on Excess Contributions to Black Lung Benefit Trust Under Section 4953 and Computation of Section 192 Deduction. Your recommendation is valid for 1 year in Maine and you will need to re-certify your license with another appointment when it expires.

4042 but is a 625 gross receipts tax on revenue from digital advertising. Taxpayer Contact Center general tax questions tax registrations motor vehicle excise tax refund status information and electronic services password assistance 207-624-9784. PO Box 1057 Augusta ME 04332-1057.

The reimbursement rate is 75 for the thirteenth year claimed and then the rate is reduced by five percentage points annually until the rate is 50. E-Mail Us Your Tax Questions.

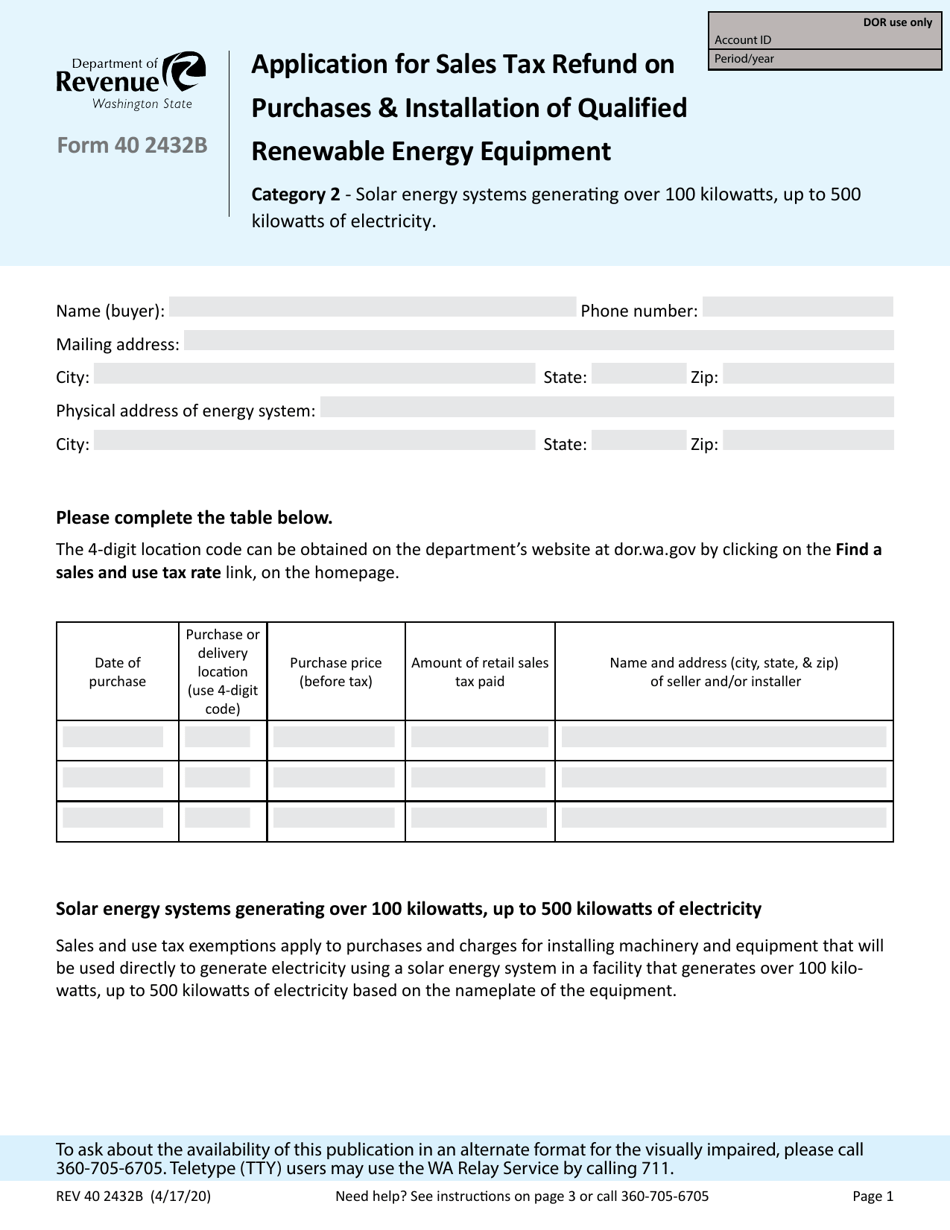

Form 40 2432b Download Fillable Pdf Or Fill Online Application For Sales Tax Refund On Purchases Installation Of Qualified Renewable Energy Equipment Washington Templateroller

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep